After DeepSeek, Chinese fund managers beat High-Flyer's path to AI

Friday, March 14th 2025, 3:00:11 am

article

Chinese hedge fund High-Flyer's use of artificial intelligence in trading markets has spurred an AI arms race among mainland asset managers that could shake up the country's $10 trillion fund management industry. Quant fund High-Flyer not only deployed AI in its multi-billion dollar portfolio, it also built China's most notable AI start-up DeepSeek whose cost-effective large language model stunned Silicon Valley and undermined Western dominance of the AI sector. In its wake, aspiring Chinese hedge fund managers such as Baiont Quant, Wizard Quant and Mingshi Investment Management are stepping up AI research, while dozens of mutual fund companies are rushing to incorporate DeepSeek into their investment workflow.

Breaking

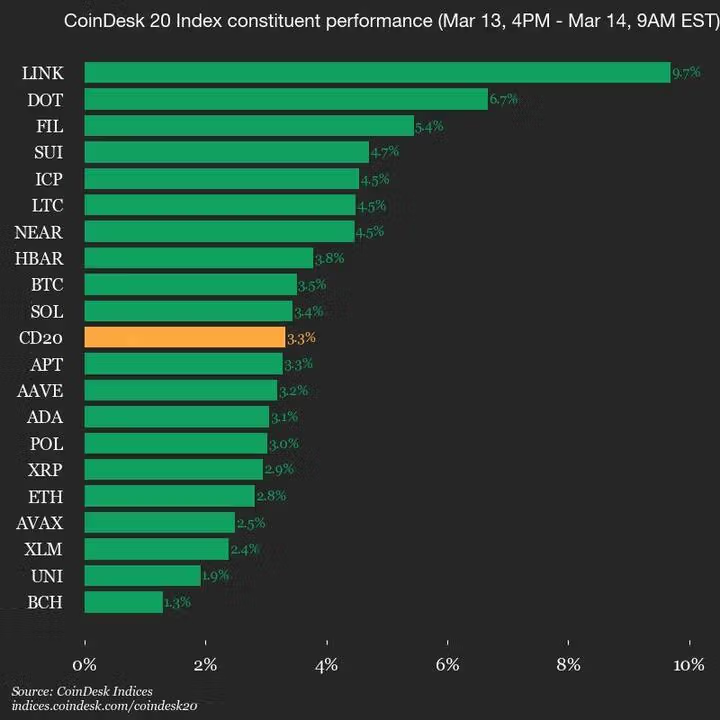

CoinDesk 20 Performance Update: Index Gains 3.3% as All Twenty Assets Move Higher...