Morning Bid: Markets shake off volatility, but will it last?

Tuesday, August 13th 2024, 9:48:36 pm

article

Markets have bounced back nicely from the recent volatility, and it's becoming clearer each day that the recent turbulence was likely due to the unwinding of large leveraged positions, like yen-funded carry trades, rather than deeper concerns about global growth. The July CPI numbers might not show much improvement from the previous month, but as long as there isn’t a big surprise, investors might still hope for the Fed to start easing in September. Futures markets currently show a 54% chance of a 50 basis point cut by the Fed, with a 46% chance of a 25 basis point cut, and traders are pricing in a full percentage point of easing by year-end.

Breaking

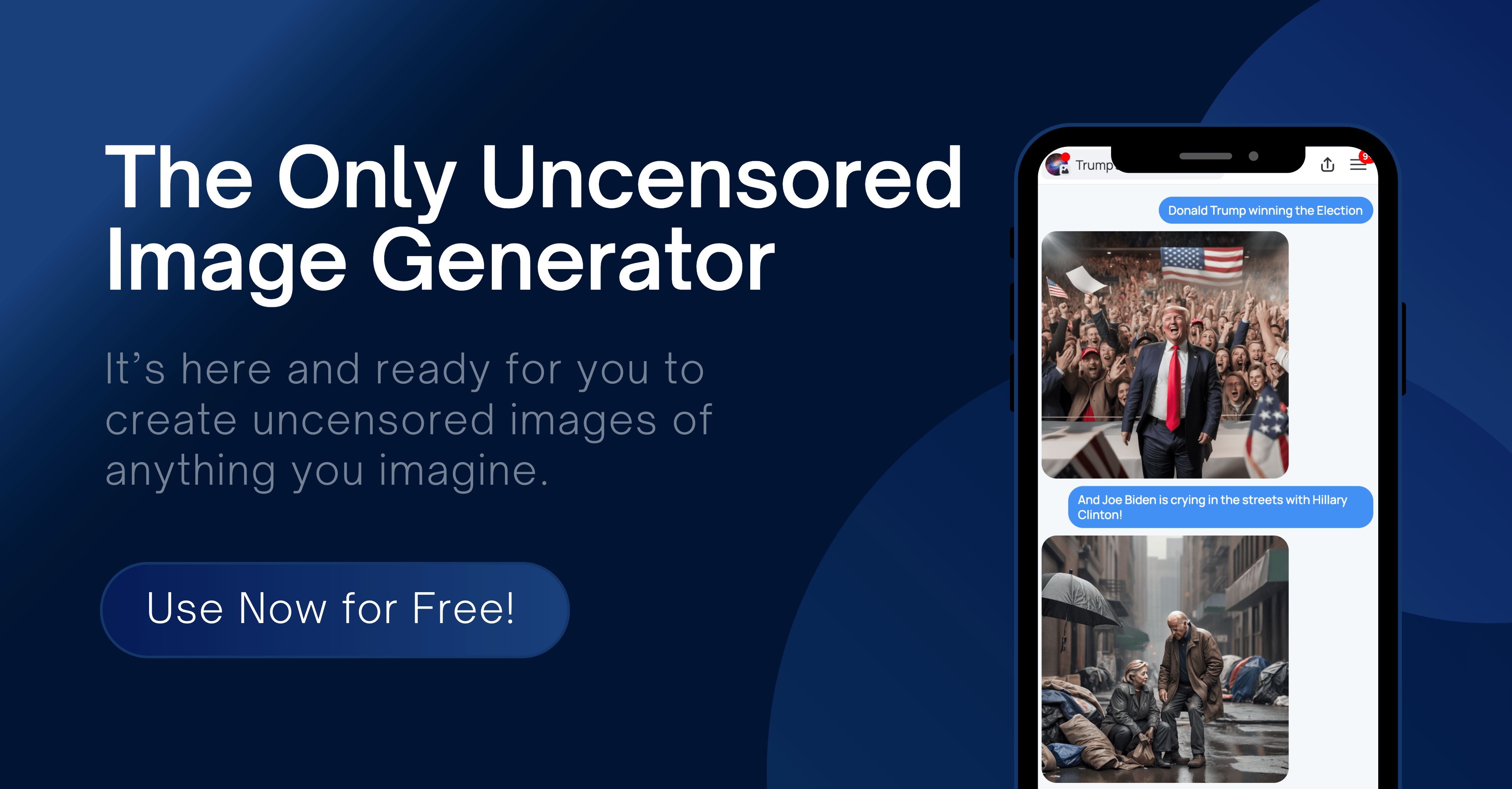

I can find no evidence that this is satire....

The US military commanders have been reportedly offering troops an extremist Christian reasoning to justify Donald Trump’s attack on Iran...