DISSENTER TRENDS

BREAKING

- The parents of a Hamas hostage made a video urging leaders to "get a deal done."...

- ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero...

- Michelle Reyes caught an image of a mysterious "flying cylinder" from her airplane window above LaGuardia Airport....

- A cheerleader at a high school in Texas lost her valedictorian title, risking a potential scholarship, over a miscalculation with her GPA....

- Angel Kenmore, 17, told NewsNation national correspondent Alex Caprariello that he saw a "giant creature" who he believes may have been a "demon" but "only God knows."...

- CAIR complained after USC cleared an encampment that anti-Israel protesters had set up at the private Los Angeles campus....

- A top Hamas political official told The Associated Press the Islamic militant group is willing to agree to a truce of five years or more with Israel and that it would lay down its weapons and convert ...

- Several allies of former President Donald Trump and members of Arizona's Republican Party were indicted in the alternate electors plot....

- One 18-year-old male student was fatally shot outside the school, and one suspect is in custody....

- But that’s no reason for the U.S. to get involved....

- The CCTV footage shown at the domestic abuse trial was disturbing: The defendant is seen dragging his wife by her hair, and then punching and kicking her. The trial of businessman Kuandyk Bishimbayev...

- CDC's provisional figures show a 2% decline in births from 2022 to 2023....

- The powers of chemical unreason are on the ascent in the nation’s capital....

- The victims of former Team USA Doctor Larry Nassar will receive a $138.7 million from the government after the FBI botched the investigation....

- The 39-year-old Dnipro resident was trying to paddle his way on the Dniester after paying someone $4,200 to coordinate his crossing, per officials....

- Budapest supports Beijing’s plan as a potential basis for peace in Ukraine, Hungarian Foreign Minister Peter Szijjarto has said...

- ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero...

- An Arizona grand jury indicted 18 people in connection with an alleged attempt to use alternate electors after the 2020 election....

- Former Attorney General Bill Barr said Thursday on Fox Business Network's "Kudlow" that Republicans had to win the November elections because Vice President Kamala Harris was in the "batting circle wi...

- Cassidy Hutchinson, a former aide to White House chief of staff Mark Meadows, said Wednesday on CNN's "The Source" that it was really sad that people who are loyal to former President Donald Trump end...

- On Wednesday's broadcast of MSNBC's "Alex Wagner Tonight," Rep. Ilhan Omar (D-MN) stated that House Speaker Rep. Mike Johnson's (R-LA) visit to Columbia | Clips...

- ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero...

BREAKING

- Columbia organizer Khymani James told reporters that all who avoid bigotry are welcome at the protest, but he led the expulsion of three Jewish students from the demonstators' camp....

- ...

- ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero...

- President Biden mocked President Trump for urging Americans to pray and read their Bibles. During Holy Week, the former president […]...

- Football is in the air, as we are less than 24 hours from the start of the draft. Which means it's time to start talking about tax reform....

- Alexandria Ocasio-Cortez and Jared Moskowitz clashed over the latter's condemnation of Bernie Sanders....

- ...

- Activist DEI Judge Abena Darkeh is proving yet again that the judiciary in NYC is rotten to the core in a 2A case that could go to SCOTUS....

- Fox News host Jesse Watters raises concerns over the anti-Israel protests across America and its participants on "Jesse Watters Primetime."...

- ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero...

- BUFFALO, N.Y. (WIVB) — A former employee of Russell Salvatore has filed a lawsuit, accusing the restauranteur of sexual assault, harassment, discrimination and wrongful termination. The suit, filed on...

- Secret Service agent on VP Harris' detail removed from assignment after physical fight while on dutyA Secret Service agent was removed from their assignment Monday after they started a physical fight with other agents, a source told Fox News Digital....

- Secret Service agent on VP Harris' detail removed from assignment after physical fight while on dutyA Secret Service agent was removed from their assignment Monday after they started a physical fight with other agents, a source told Fox News Digital....

- ...

- ...

- The fake GOP won't quit lying about who they are....

- House Speaker Mike Johnson, R-La., spoke out on "Jesse Watters Primetime" after addressing students on Columbia University's campus, where he faced anti-Israel crowds....

- NASA re-establishes communication with Voyager 1 interstellar spacecraft that went silent for monthsNASA re-established communication with Voyager 1, an interstellar spacecraft that nearly five months ago began sending unreadable data back to the space agency....

- ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero...

- Oklahoma man 'bludgeoned' girlfriend's relative with brick before dumping remains in wildlife refugeTevin Terrell Semien and Nicole Leigh Logsdon pleaded guilty to second-degree murder for the killing of Karon Smith in Oct. 2023....

- Amnesty International said in its annual report Wednesday that authorities in Togo have prevented civilians from protesting peacefully, and have repressed the media....

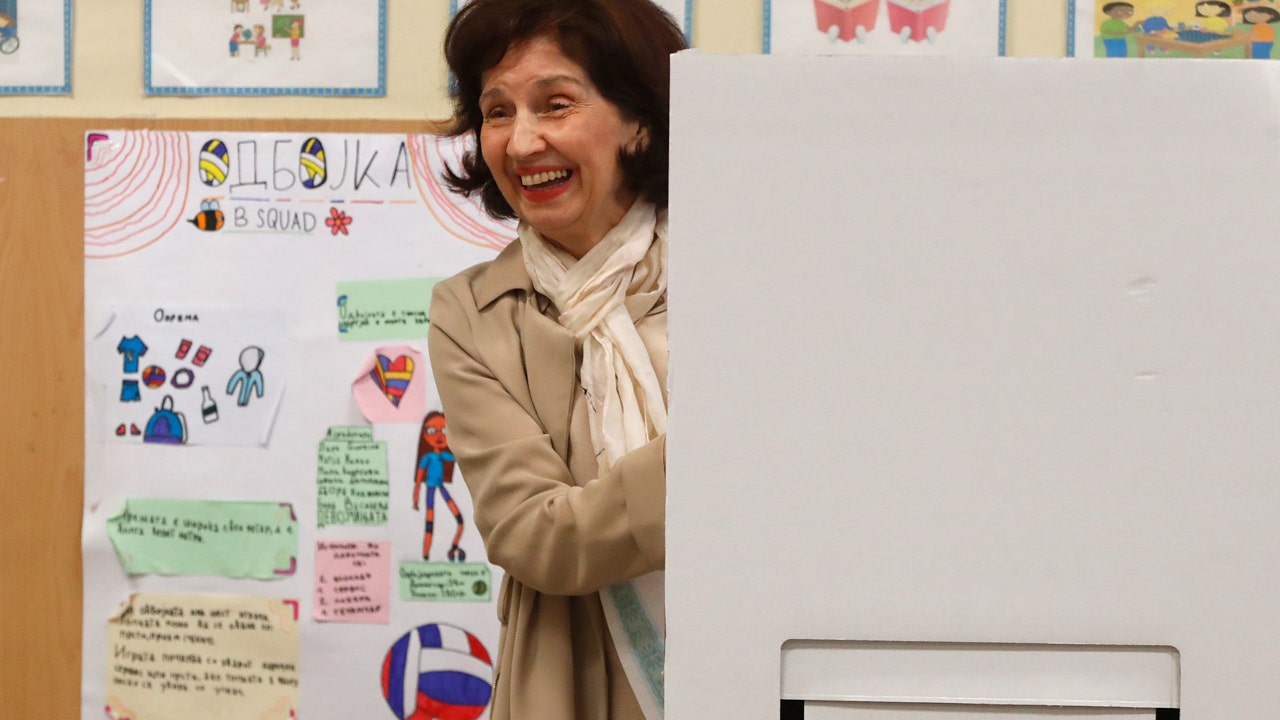

- North Macedonia will hold a presidential runoff on May 8 after no candidate secured enough support from voters to win outright; voting will coincide with parliamentary elections....

Past 24 Hours

0 visits

Past 7 Days

0 visits

Past 30 Days

0 visits

Dissenter Trends is the first people-powered newsroom. Dissenter Trends provides a realtime pulse on what the internet is discussing right now.

Dissenter Trends decentralizes news discovery away from gatekeepers and creates a level playing field for mainstream, alternative, and citizen journalists to share their story with the world.